Published on January 12, 2021 by Ayman Nuhuman

Global Interbank Offered Rates (IBOR)1 are in the process of being replaced by the end of 2021. It is estimated that these interest rates serve as benchmarks for loans, bonds, mortgages and derivatives worth over USD350tn in financial assets.

Historically, IBOR submissions have been made on expert judgment rather than actual transactions. This led to manipulation in the IBOR market, and global banks have paid a heavy price for their role in it. As a result of the scandal, IBOR will be replaced with Alternative Reference Rates (ARRs) by the end of 2021. ARRs will be based on actual transactions, unlike IBOR that are based on expert judgment, which led to collusion.

Banks and financial institutions are in the process of re-papering their contracts to reflect the new reference rates, which are expected to differ across currencies and jurisdictions. Given the fast-approaching deadline, financial institutions face varied challenges in transitioning to what is regarded as the biggest change in the financial universe since the introduction of the euro.

The industry’s transition has been on track, with the latest guidance coming from the International Swaps and Derivatives Association (ISDA), which released the IBOR Fallbacks Supplement and Protocol in late October 2020. Other industry bodies, including the Financial Conduct Authority and the ICE Benchmark Association, have initiated consultative discussions with their stakeholders for a world post IBOR.

According to the latest ISDA transition report, one of the key performance indicators of the rate transition is the ISDA-Clarus RFR Adoption Indicator, which measures how much global trading activity is conducted in cleared OTC and exchange-traded interest rate derivatives (IRD) that reference the identified risk-free rates in six major currencies. The ISDA-Clarus RFR Adoption Indicator was at 7.7% in 3Q20 versus 4.5% in 2Q20, signalling progressive conversion overtime.

The trading activity mirrors a recent report by Duff & Phelps that highlighted that c.65% of the firms surveyed had not completed planning for the rate transition. The Duff & Phelps report also stated that c.45% of the respondents have considered the transition and that one in five (20%) has conceded that they have not commenced the process.

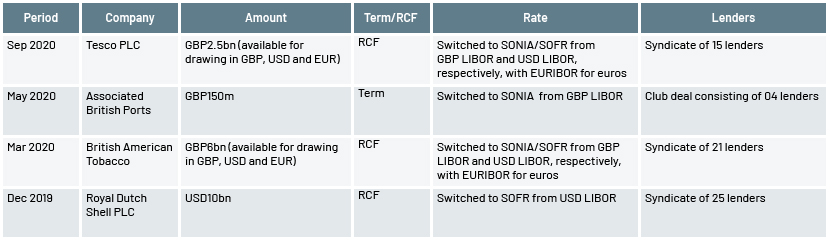

The Loan Market Association’s (LMA’s) transition to the new rates will likely be slower than that of the more structured markets such as the derivatives market. To increase visibility, the LMA has begun publishing data of companies that opt for loans under the new interest rate regime. The following table outlines a few notable loan transactions.

1Including LIBOR, EURIBOR and EONIA

Source: https://www.lma.eu.com

The implementation timeline is not expected to change, although there will likely be delays due to the global pandemic and the current economic environment. The Financial Conduct Authority (FCA) of the Bank of England and the Financial Stability Board are committed to maintaining the international timeline. The Alternative Reference Rates Committee (ARRC), convened by the Federal Reserve Board and the New York Fed, is also working towards the pre-agreed timeline.

Financial institutions have to test all their in-house valuation methodologies and tools to price the financial instruments in their respective funding, investing and hedging portfolios to support the new rates. This would include assessing the impact of the rate transition on contract terms, financial models, transaction systems and accounting policies. Given the evolving guidance from regulators, industry associations, clearing houses and working groups, the transition will likely be a tedious project management exercise.

This transition will require banks to identify and re-paper large volumes of credit agreements by end-December 2021. Depending on the bank, loan templates may vary between those from the LMA and those from the Loan Syndications and Trading Association (LSTA), which cut across multiple industries and geographies. Complexities of the documents may also increase, considering the likely restatements and amendments, and it is important that the financial institutions be able to re-paper the agreements accurately and back-test their internal models to ensure a smooth transition.

Due to volume and document complexities (with certain agreements running to more than 2,000 pages), it is imperative that financial institutions use artificial intelligence (AI)/natural-language processing (NLP) tools to complete the transition. Firms would also need to invest the time to train the algorithm to capture the required information. Experience indicates that smoothening the process to capture the *right* data could take one to three months, as a large number of iterations may be required.

As highlighted above, re-papering would be time-consuming and add to a bank’s workload. According to a recent FT article, banks are increasingly using AI/NLP tools that are highly productive and more cost-efficient than hiring a large number of lawyers to re-paper the contracts. With the fixed timeline, banks and other financial institutions are likely to face added pressure to comply with this regulatory requirement.

Certain firms do not have the human capital required to effect the transition, further aggravating the challenge. There could be a shortfall of c.250,000 skilled professionals to handle this global transition that involves handling sensitive and complicated documentation, according to research by Momenta Group.

Given the high volume of contracts and the time investment required to understand the fallback provisions and re-paper contracts, financial institutions would have to explore obtaining assistance from firms that are skilled in this area.

Acuity Knowledge Partners has the extensive know-how and expertise required to effect a smooth IBOR transition. Our expertise includes document management, testing and training algorithms and manual remediation using AI tools.

Sources:

https://www.isda.org/a/Bi4TE/Transition-to-RFRs-Review-Q3-of-2020-and-Year-to-September-30-2020.pdf

What's your view?

About the Author

Ayman Nuhuman has over 14 years of work experience including two years in commercial lending. He is currently part of the IBOR transition team for leading European bank. Prior to Acuity Knowledge Partners, he was part of a boutique consulting firm in Sri Lanka. Ayman has exposure in Management Accounting and Auditing from one of the Big four audit firms in the Sri Lanka. Ayman is Associate Member of Chartered Institute of Management Accountants (UK) and has completed Level I examination of the Chartered Financial Analyst examination.

Like the way we think?

Next time we post something new, we'll send it to your inbox